Author: Asher

Zama Conducts Token Launch on Its Own Platform

Project Overview

Zama is a company specializing in Fully Homomorphic Encryption (FHE) technology, one of the most cutting-edge innovations in the privacy computing field. To date, Zama has completed two rounds of funding, raising a total of $130 million. In March 2024, Zama announced a $73 million Series A round co-led by Multicoin Capital and Protocol Labs. In June 2025, Zama announced a $57 million Series B round led by Blockchange Ventures and Pantera Capital.

Participation Guide and Details

Auction Pre-registration Link: https://www.zama.org/auction;

Auction Method: Sealed Bid Dutch Auction (For a detailed explanation, read: Zama Public Sale Too Complex? A Guide to Understanding Sealed Dutch Auctions);

Auction Time: Scheduled from January 12 to 15, with token claims starting on January 20;

Public Sale Allocation: 10% of the total token supply, with 8% sold via auction and 2% sold at a fixed price post-auction (capped at $10,000 per person);

Lock-up Details: Zama tokens purchased in the auction will be fully unlocked.

Octra Conducts Token Launch on Sonar Platform

Project Overview

Octra is an L1 project in the privacy sector, supporting an FHE blockchain network with isolated execution environments. In terms of token distribution, early investors hold 18%, Octra Labs holds 15%, and the remaining 67% is allocated to the community, including early users, validators, ecosystem grants, Echo participants, and this public sale. No single investor holds more than 3% of the tokens.

In September 2024, Octra announced a $4 million Pre-Seed funding round led by Finality Capital, with participation from Big Brain Holdings, Karatage, Presto, Builder Capital, and others.

Participation Guide and Details

Octra announced it will conduct a public token sale on Sonar (an ICO platform founded by Echo and recently acquired by Coinbase):

Official Token Sale Platform Account: https://x.com/echodotxyz (The specific token sale website has not been announced yet, but account registration is now open);

Event Start Time: December 18;

Sale Quantity: 10% of the total token supply. Notably, the team stated that if subscription demand is strong, the allocation ratio may be increased;

Sale Model: Fixed price of $0.20, aiming to raise $20 million, corresponding to a Fully Diluted Valuation (FDV) of $200 million;

Unlock Details: Not yet announced.

Rainbow Conducts Token Launch on CoinList Platform

Project Overview

Rainbow is a Web3 wallet project designed to help users easily explore and manage their assets, including NFT collections, DeFi application connections, and cross-chain bridging, through a simple, intuitive, and secure user interface. Rainbow emphasizes a design philosophy of "fun, simple, and secure," akin to a "Robinhood" tailored for Web3, lowering the entry barrier for newcomers to the crypto world. It supports ENS domain integration and offers a seamless experience on both mobile and desktop.

To date, Rainbow has raised nearly $20 million in funding.

Participation Guide and Details

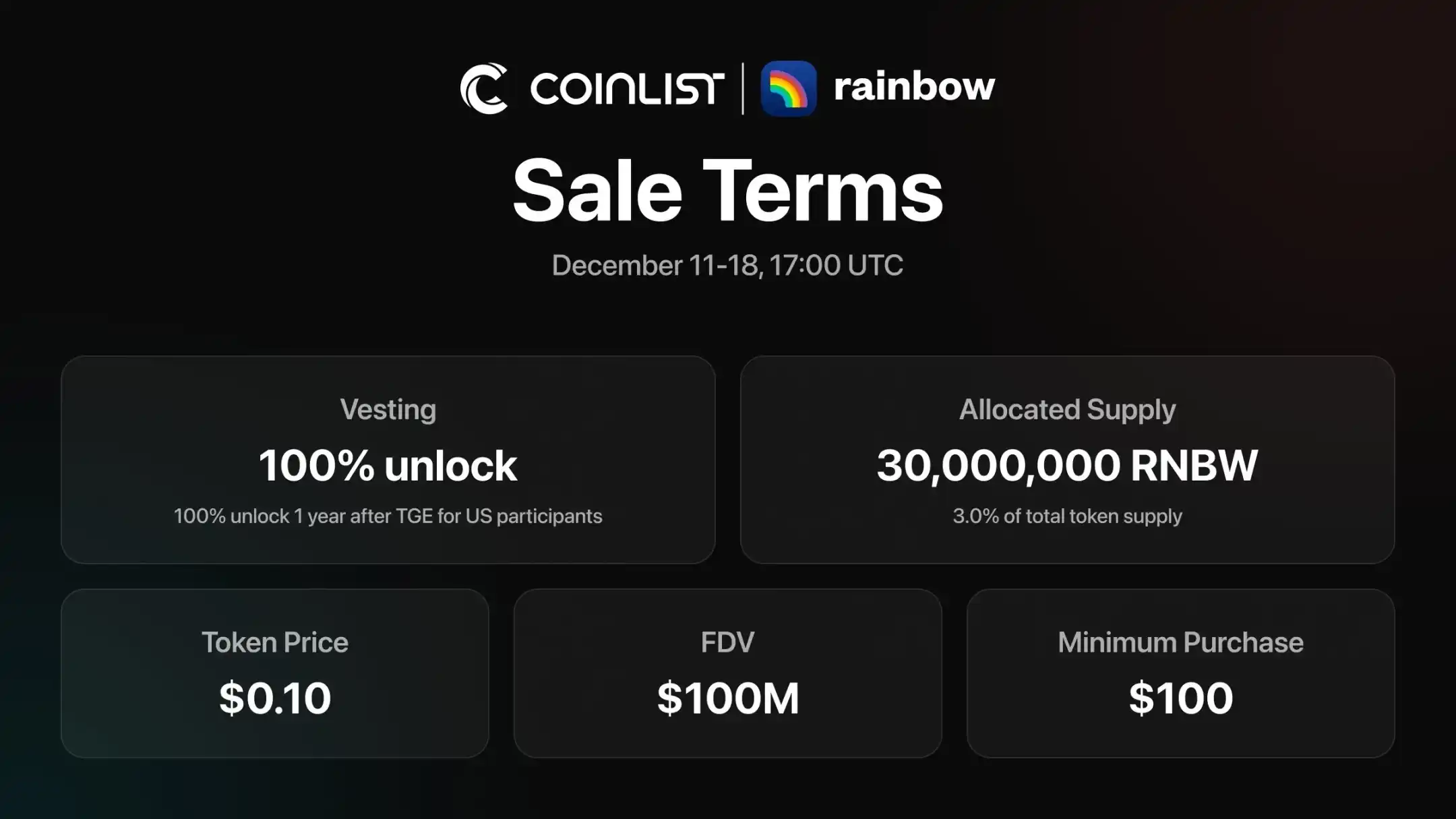

Rainbow announced it will conduct a public token sale on CoinList:

Token Sale Website: https://coinlist.co/rainbow;

Event Start Time: 1:00 AM Beijing Time on December 12;

Sale Quantity: 3% of the total token supply, i.e., 30 million RNBW tokens;

Sale Model: Fixed price of $0.10;

Unlock Details: Fully unlocked at TGE (US users will be unlocked one year post-TGE);

Minimum Investment: $100.

Gensyn Conducts Token Launch on Its Own Platform

Project Overview

Gensyn is an open network for decentralized AI systems. In March 2022, Gensyn announced a $6.5 million seed round led by Eden Block. In June 2023, Gensyn announced a $43 million Series A round led by a16z.

Participation Guide and Details

Token Sale Website: https://token.gensyn.network/;

Event Start Time: December 15;

Sale Quantity: 5% of the total token supply (3% for the sale, plus an additional 2% for rewards);

Sale Model: English Auction with a valuation cap. Specifically, the valuation floor is $1 million FDV ($0.0001 per token), and the cap is $1 billion FDV ($0.10 per token), with a minimum price increment of $0.0001;

Unlock Details: Fully unlocked at TGE (US users will be unlocked one year post-TGE). Choosing to lock-up grants an additional 10% token reward;

Minimum Investment: $100.

Infinex Conducts Token Launch on Sonar Platform

Project Overview

Infinex is a decentralized finance platform launched by Synthetix founder Kain Warwick in April 2024. The project aims to bridge the gap between CeFi and DeFi, offering the smooth user experience of a centralized exchange while maintaining the non-custodial and secure nature of decentralized services.

Participation Guide and Details

On November 27, Infinex, a new project created by Synthetix founder Kain Warwick, officially announced its upcoming TGE and plans to conduct a public sale on Sonar with a $300 million FDV. It intends to sell 5% of the INX token supply to raise $15 million, choosing Sonar as the launch platform.

According to Infinex's official introduction, this public sale will have two participation paths: a guaranteed quota and a lottery allocation. The guaranteed quota is for users holding liquid (unlocked) Patron NFTs, with specific guarantee strategies as follows:

- 1 Patron NFT: $2,000 quota;

- 5 Patron NFTs: $15,000 quota;

- 25 Patron NFTs: $100,000 quota;

- 100 Patron NFTs: $500,000 quota;

Allocations follow a cumulative mechanism. For example, if you hold 32 liquid Patron NFTs, your quota will be: 100,000 + 15,000 + 2,000 + 2,000 = $119,000.

The lottery allocation is open to all users; anyone can apply to participate. The specific rules are as follows:

Minimum subscription amount is $200, maximum is $5,000;

If subscriptions exceed the limit, orders will be allocated via lottery;

Each order has an equal chance of being selected. If selected, the order will be fully allocated;

Unfulfilled orders will be automatically refunded.

Notably, this public sale will have a one-year lock-up period but includes an early unlock clause. The design for early unlock is as follows:

At TGE, if early unlock is chosen, the subscription will be at a price corresponding to a $1 billion FDV;

During the one-year lock-up period, this price will linearly decrease to the initially set $300 million FDV;

If the trading price of INX after listing is higher than the real-time early unlock price, some public sale participants may choose to unlock early, smoothing the unlock curve.

Fogo Conducts Token Launch on Its Own Platform

Project Overview

Fogo is a new Layer 1 blockchain based on the Solana Virtual Machine (SVM). Its technical architecture aims to address the performance bottlenecks of existing blockchains, providing a more efficient and lower-cost transaction experience. Fogo has currently completed seed and community funding rounds, raising a total of $13.5 million.

Participation Guide and Details

Token Sale Website: https://presale.fogo.io/. USDC transfer functionality is now open; users can pre-transfer USDC to their Fogo wallet (Transfer Tutorial: https://community-docs.fogo.io/getting-started/transferring-to-fogo).

Event Start Time: December 17;

Sale Quantity: 2% of the total token supply;

Sale Model: First-come, first-served; price unknown;

Unlock Details: Fully unlocked at TGE (US users will be unlocked one year post-TGE). Choosing to lock-up grants an additional 10% token reward;

Minimum Investment: $100.

Football.Fun Conducts Token Launch on Legion Platform and Kraken Exchange

Project Overview

Football.Fun is a sports prediction market platform deployed on the Base network. On July 18, Football.Fun announced a $2 million seed funding round led by sports-focused investment firm 6th Man Ventures (6MV), with other investors including Devmons, Zee Prime Capital, Sfermion, and The Operating Group.

Participation Guide and Details

On December 9, Football.Fun announced it will conduct a public token sale on the Legion platform and Kraken exchange. Specific details have not been announced yet. Currently, KYC verification for both launch platforms can be completed using a passport.